Quantum computing could be commercial real estate’s next big tailwind

**Quantum Computing’s Rise to Prominence: A New Era in Tech Real Estate**

The rapid advancement of quantum computing has brought us to an inflection point: the need for dedicated real estate to support this burgeoning industry. As investors, it’s essential to understand the implications of this development and how it may shape the future of tech investments.

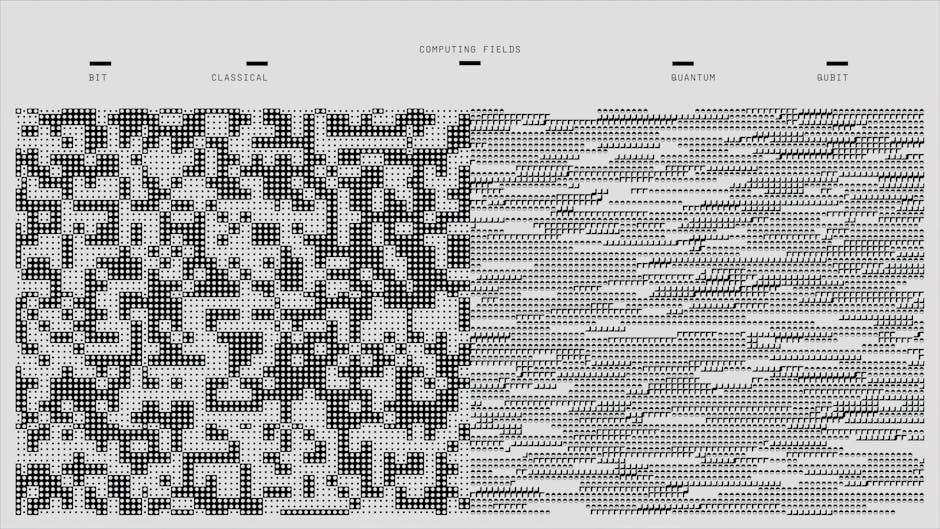

**The Rise of Quantum Computing**

In recent years, quantum computing has transitioned from a theoretical concept to a commercially viable technology. This shift is driven by significant investments from tech giants like Google, IBM, and Microsoft, who are racing to develop practical applications for this powerful computing paradigm. With market capitalization of these companies reaching trillions of dollars, it’s clear that quantum computing is no longer just a niche area of research.

**The Need for Dedicated Real Estate**

As quantum computing becomes more widespread, it requires specialized facilities to support its unique infrastructure needs. These include highly controlled environments to maintain the fragile quantum states, advanced cooling systems, and sophisticated power management. The demand for custom-built data centers, laboratories, and research facilities is on the rise, creating a new market for tech real estate investments.

**Market Context and Analysis**

The growth of quantum computing is not without its challenges. Volatility in the tech sector, combined with the high barriers to entry for new players, may lead to consolidation and partnerships between established companies. This could result in a more stable and collaborative environment, ultimately driving innovation and investment opportunities.

**Key Players and Investment Opportunities**

Several companies are already positioning themselves to capitalize on the growing demand for quantum computing real estate:

* **Data center providers**: Companies like Equinix, Digital Realty, and Interxion are well-positioned to provide customized data center solutions for quantum computing applications.

* **Real estate investment trusts (REITs)**: REITs specializing in tech real estate, such as CoreSite Realty and QTS Realty Trust, may benefit from the increasing demand for specialized facilities.

* **Quantum computing startups**: Companies like Rigetti Computing, IonQ, and Quantum Circuits Inc. (QCI) are developing innovative quantum computing solutions and may require dedicated real estate to support their growth.

**Actionable Insights for Investors**

As the quantum computing industry continues to evolve, investors should consider the following:

* **Diversify your tech portfolio**: Include companies involved in quantum computing real estate to spread risk and capitalize on emerging trends.

* **Monitor industry developments**: Keep a close eye on breakthroughs, partnerships, and investments in the quantum computing space to identify potential opportunities.

* **Evaluate the potential of quantum computing REITs**: Consider the unique benefits and challenges of investing in REITs focused on quantum computing real estate.

**Looking Ahead**

As quantum computing becomes increasingly commercialized, the need for dedicated real estate will continue to grow. Savvy investors who stay ahead of the curve and adapt to this emerging trend may reap significant rewards. With the tech sector’s market cap expected to continue its upward trajectory, now is the time to explore the opportunities presented by quantum computing’s rise to prominence.

📈 Stay Updated: Explore more market insights on our financial blog or browse latest market analysis.

💡 This analysis is for informational purposes only and should not be considered as financial advice.