Gainers & Losers: IDBI Bank soars 9% See 5 more stocks in focus on Nifty expiry day

**Indian markets Continue Upward Trajectory: Nifty Touches 25,083, Sensex 82,000**

The Indian stock market has extended its winning streak to six consecutive days, with the Nifty closing at 25,083 and the Sensex reaching 82,000. This upward trend is a testament to the market’s resilience and investor confidence in the face of global economic uncertainty.

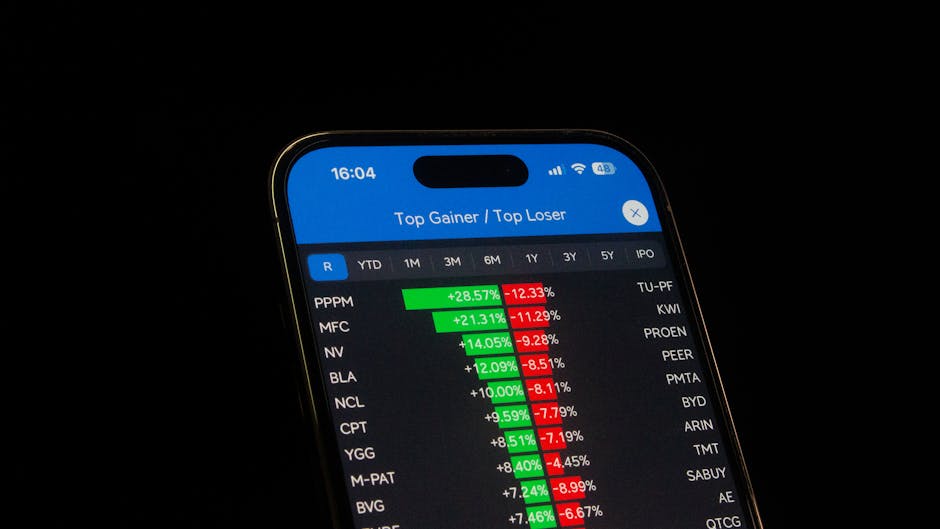

**Market Movers: Winners and Losers**

Several stocks made significant gains, contributing to the market’s overall positive performance. Notable winners include:

* Swiggy, the food delivery giant, which saw its shares surge on the back of strong quarterly earnings.

* Reliance firms, which benefited from the conglomerate’s diversified business portfolio and robust financials.

* IDBI Bank, which continued its upward momentum following the bank’s successful capital raising exercise.

On the other hand, some stocks slipped, including:

* BSE (Bombay Stock Exchange), which faced selling pressure due to concerns over trading volumes.

* Angel One, the brokerage firm, which was impacted by market volatility and investor caution.

* Ola Electric, the electric vehicle manufacturer, which faced profit-booking after a recent rally.

**Market Context: What’s Driving the Rally?**

The current market rally can be attributed to a combination of factors, including:

* Strong corporate earnings: Many Indian companies have reported robust quarterly results, boosting investor sentiment and driving up stock prices.

* Central bank support: The Reserve Bank of India’s (RBI) accommodative monetary policy stance has helped maintain liquidity and support economic growth.

* Global cues: A rebound in global markets, particularly in the US, has also contributed to the Indian market’s upward momentum.

**Investment Insights: What Does This Mean for Retail Investors?**

While the current market trend is encouraging, retail investors should remain cautious and focused on their long-term investment objectives. Here are some key takeaways:

* Diversification is key: Spread your investments across various asset classes and sectors to minimize risk and maximize returns.

* Quality matters: Focus on stocks with strong financials, robust business models, and proven track records.

* Volatility is inherent: Be prepared for market fluctuations and avoid making impulsive investment decisions based on short-term market movements.

**Looking Ahead: Key Takeaway**

As the Indian market continues its upward trajectory, retail investors should remain vigilant and focused on their investment strategies. With global economic uncertainty still prevalent, it’s essential to prioritize risk management and diversification. By doing so, investors can navigate potential market volatility and position themselves for long-term success.

Word count: 546

📈 Stay Updated: Explore more market insights on our financial blog or browse latest market analysis.

💡 This analysis is for informational purposes only and should not be considered as financial advice.